In the world of startup fundraising, cold email outreach can be a game-changer. This guide explores how to craft compelling messages that grab investors’ attention. We’ll look at how to do thorough due diligence and use smart vetting tactics to increase your success.

Cold email outreach is more than sending a generic pitch. It’s about creating targeted, personalized messages that show your startup’s value. This guide will help you navigate the complexities of cold emailing. It ensures your startup shines in crowded inboxes.

Key Takeaways

- Personalize your cold emails for each investor

- Conduct thorough research before reaching out

- Highlight your startup’s unique value proposition

- Follow legal and ethical guidelines in your outreach

- Track and analyze your email performance

- Be persistent but respectful in follow-ups

Understanding the Fundamentals of Cold Email Due Diligence

Cold email due diligence is key for startups looking for seed funding. It’s about making a great first impression and showing you’ve done your homework. Let’s explore the main parts of this process.

Defining Effective Due Diligence Processes

An effective due diligence process means doing deep research on potential investors. Look into their past investments, the companies they’ve backed, and the industries they focus on. Tailoring your approach can boost your chances of getting seed funding.

Key Components of Professional Cold Outreach

Professional cold outreach needs a well-written message. Your email should be short, personal, and show what makes you special. Include a brief startup overview and a clear call-to-action.

| Component | Description |

|---|---|

| Subject Line | Engaging and relevant to the investor |

| Introduction | Brief company overview and reason for contact |

| Value Proposition | Clear statement of your unique offering |

| Call-to-Action | Specific request for next steps |

Legal Compliance and Regulatory Considerations

When contacting investors, following legal and regulatory rules is crucial. This means respecting anti-spam laws and making sure all claims in your pitch decks are true and can be proven. Staying compliant builds trust and keeps your startup safe from legal problems.

“Due diligence in cold emailing is not just about following up, it’s about following through with integrity and professionalism.”

Due Diligence and Vetting Email Tactics

Effective cold email outreach needs careful planning and vetting. Smart tactics help qualify leads and build trust with potential investors. Let’s look at ways to write compelling emails that connect with your audience and improve your funding chances.

Begin by making your emails personal. Research each investor well and customize your message to fit their interests and past investments. This shows you’ve done your homework and boosts your chances of getting a reply.

Then, focus on your fundraising metrics. Investors look for solid data showing your company’s potential. Include important metrics like user growth, revenue, and market success in your emails.

- Highlight your unique value proposition

- Showcase your team’s expertise

- Provide social proof through customer testimonials or partnerships

Keep your emails short and to the point. Investors get many pitches every day. Make yours stand out with clear, impactful language.

| Email Element | Purpose | Example |

|---|---|---|

| Subject Line | Grab attention | “Innovative AI Solution – 200% YoY Growth” |

| Opening | Personalize | “Your recent investment in X aligns with our vision” |

| Body | Present value | “Our platform has reduced client costs by 40%” |

| Call-to-Action | Encourage response | “Available for a 15-minute call this week?” |

By using these tactics in your cold email outreach, you’ll have a better chance of reaching the right investors. This will help you move forward in the fundraising process.

Crafting Compelling Investor-Ready Pitch Decks for Cold Outreach

Making pitch decks that catch eyes is key for cold outreach success. A good deck can mean the difference between getting funding and being ignored. Let’s look at what makes your pitch shine.

Essential Elements of a Winning Pitch Deck

Your deck should tell a story about your startup. Start with a clear problem and your unique solution. Then, show the market opportunity and your team’s skills.

Outline your business model and present your startup’s value and funding needs. This will help investors understand your vision.

Visual Presentation Strategies

Visuals make your pitch memorable. Use consistent branding in your deck. Choose clean, professional designs that show your company’s identity.

Break down complex ideas with simple infographics or diagrams. Remember, fewer slides are often better.

Data Visualization Best Practices

Numbers tell a strong story when shown correctly. Use charts and graphs for growth, market size, and financial data. Pick the right visualization for each data set.

Bar charts are great for comparisons, while line graphs show trends. Keep your visuals simple and colorful to highlight important points.

- Keep visualizations simple and easy to understand

- Use color to highlight key points

- Ensure all data is accurate and up-to-date

By focusing on these tips, you’ll make pitch decks that clearly show your startup’s potential. This will boost your chances of getting funding through cold outreach.

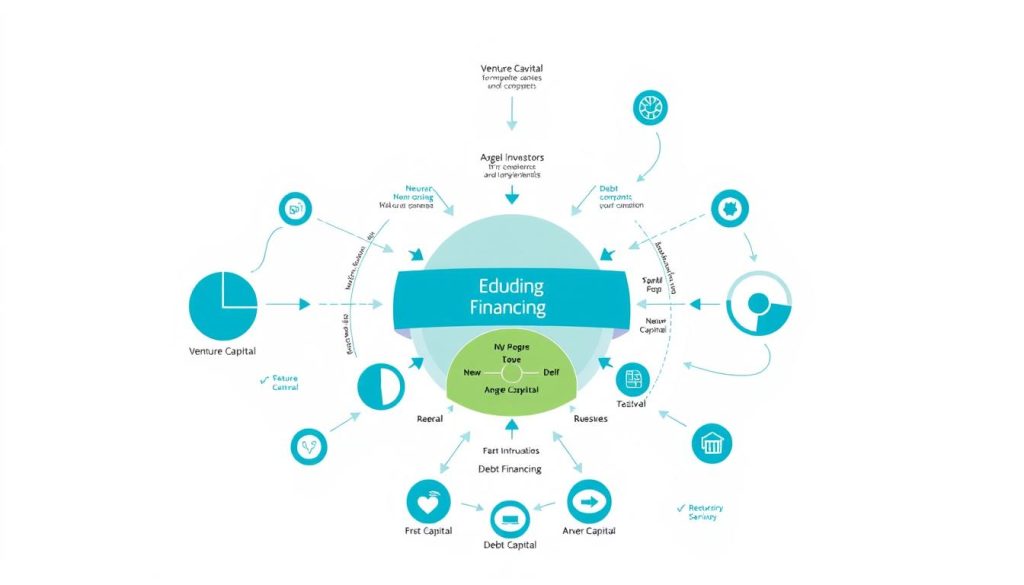

Building a Targeted Investor Database

Creating a targeted investor database is key for startups looking for seed funding. It means finding venture capital firms that match your business goals and industry. A good database makes your outreach efforts more focused and boosts your investment chances.

Begin by researching venture capital firms that focus on your sector. Look for those who have funded startups like yours before. Industry events, online platforms, and professional networks are great for finding potential investors.

After finding potential investors, sort them by factors like investment size, industry focus, and location. This sorting helps you tailor your approach to each investor’s needs.

| Investor Type | Focus Area | Typical Investment Range |

|---|---|---|

| Angel Investors | Early-stage startups | $25,000 – $100,000 |

| Seed-Stage VC Firms | Pre-revenue to early revenue | $250,000 – $2 million |

| Series A VC Firms | Proven business model | $2 million – $15 million |

Keep your database up to date with the latest on investors, their deals, and investment criteria. This keeps your outreach focused and effective, raising your chances of getting the right funding.

Startup Valuation Metrics for Cold Email Campaigns

To make effective cold email campaigns for fundraising, focus on key startup valuation metrics. These metrics show your company’s potential and draw investor interest. Let’s look at important fundraising metrics to include in your outreach.

Key Performance Indicators to Highlight

When you reach out to potential investors, highlight KPIs that show your startup’s growth and potential. Key metrics include:

- Monthly Recurring Revenue (MRR)

- Customer Acquisition Cost (CAC)

- Churn Rate

- Lifetime Value (LTV)

Financial Projections and Growth Metrics

Investors want to see your startup’s future potential. Include clear financial projections and growth metrics in your cold emails. Show a table with your projected revenue, user growth, and market share for the next 3-5 years.

| Year | Projected Revenue | User Growth | Market Share |

|---|---|---|---|

| Year 1 | $500,000 | 10,000 | 1% |

| Year 3 | $2,500,000 | 50,000 | 5% |

| Year 5 | $10,000,000 | 200,000 | 15% |

Market Size and Opportunity Analysis

Investors are drawn to startups with big market potential. Include a brief market size analysis in your cold emails. Mention your total addressable market (TAM), serviceable addressable market (SAM), and serviceable obtainable market (SOM). This shows you understand the opportunity and growth potential.

By using these startup valuation and fundraising metrics in your cold email campaigns, you’ll catch investors’ attention. This increases your chances of getting funding.

Equity Structure and Term Sheet Preparation

Setting up your startup’s equity and getting term sheets ready are key steps for getting equity financing. These steps are vital for talking to potential investors and getting funding.

Equity structure shows who owns what in your company. It makes sure everyone works together towards success. It’s about sharing goals and control.

Term sheets outline the deal’s main points. They cover how much money is invested, the company’s value, and how profits are split. Making clear, fair term sheets helps attract investors and speeds up talks.

Capitalization tables, or cap tables, show who owns what in your company. They list who has shares and how many. They also show how ownership changes with new investments or employee stock options.

| Stakeholder | Ownership Percentage | Number of Shares |

|---|---|---|

| Founders | 60% | 600,000 |

| Investors | 30% | 300,000 |

| Employee Stock Option Pool | 10% | 100,000 |

Knowing these parts helps founders deal with equity financing’s challenges. It lets them make smart choices and look professional to investors. This increases the chance of getting funding on good terms.

Leveraging Email Analytics for Investor Engagement

Email analytics are key to successful cold email outreach for fundraising. They help you refine your approach and boost investor engagement.

Track and Measure Email Performance

Monitoring your cold email outreach helps you see what needs work. Watch open rates, click-through rates, and response rates. These metrics show how well your subject lines, content, and calls-to-action are doing.

Response Rate Optimization

To get more responses, make your emails personal and your subject lines compelling. Try different email formats and send times to see what works best. A/B testing can help you fine-tune your strategy and boost engagement.

Follow-up Strategy Development

Having a solid follow-up plan is key for building investor relationships. Create a series of targeted follow-up emails based on what recipients do. Space out your follow-ups to avoid overwhelming them while keeping communication steady.

| Email Metric | Benchmark | Optimization Tips |

|---|---|---|

| Open Rate | 20-30% | Craft intriguing subject lines |

| Click-Through Rate | 2-5% | Include clear, compelling CTAs |

| Response Rate | 10-15% | Personalize content and timing |

By using these email analytics and strategies, you can improve your cold email outreach. This will help you get more investor meetings and funding for your startup.

Building Credibility Through Social Proof

Social proof is a strong tool in startup fundraising. It turns your cold emails and investor pitch decks into believable offers. By showing real success, you gain trust from potential investors.

Testimonials are key to social proof. Add short, powerful quotes from happy customers or partners in your emails. These stories prove your product’s worth and fits well in the market. For pitch decks, use a slide for testimonials, showing logos and feedback from big clients.

Partnerships and collaborations show your startup’s potential. Show off strategic alliances with big names. This shows you can make valuable connections, boosting your fundraising.

Achievements and milestones prove your progress. In your fundraising guide, list important wins like:

- Revenue growth figures

- User acquisition milestones

- Industry awards or recognition

- Successful pilot programs

Media coverage boosts your credibility. If you’ve been in the news, share it in your outreach. It shows your startup is noteworthy, adding to your pitch’s strength.

Always be real with social proof. Use true testimonials and achievements. This will make your fundraising more effective and draw in investors.

Conclusion

This guide gives you the tools you need to succeed in startup fundraising. By learning how to do due diligence and vetting emails, you’ll catch investors’ eyes. A great pitch deck and a targeted list of investors are your key assets.

Show off your startup’s worth with important numbers and financial plans. Use email tracking to make your emails better and get more people to open them. Also, use social proof to show you’re credible to investors.

Follow these tips to get funding and build strong relationships with investors. Keep trying, improve your plan, and watch your startup grow in the tough fundraising world.

FAQ

What are the key components of an effective cold email for startup fundraising?

An effective cold email for startup fundraising has a few key parts. Start with a catchy subject line and a personalized greeting. Then, clearly state your value proposition and share relevant metrics and achievements.

Make sure your call-to-action is clear and your signature looks professional. Tailor your message to each investor, showing how your startup fits their interests.

How can I ensure my cold emails comply with legal and regulatory requirements?

To comply with laws like the CAN-SPAM Act, include a physical address and a clear unsubscribe option. Avoid misleading subject lines and respect data privacy laws. If needed, get consent.

It’s wise to consult a legal expert to make sure you’re following all the rules in your area.

What are some effective strategies for building a targeted investor database?

To build a targeted investor database, research venture capital firms and angel investors in your field. Attend startup events and use LinkedIn to network. Also, use specialized databases and tools for fundraising.

Focus on investors who have backed startups like yours in your sector.

How can I create a compelling investor pitch deck for cold email outreach?

For a compelling pitch deck, focus on your problem, solution, market, and business model. Include your traction, team, and financial plans. Use designs and data visualizations that grab attention.

Keep it short, aiming for 10-15 slides. Customize the content for each investor you target.

What startup valuation metrics should I include in my cold email campaigns?

Include metrics like Monthly Recurring Revenue (MRR), Customer Acquisition Cost (CAC), and Lifetime Value (LTV). Also, mention your churn rate, growth rate, Total Addressable Market (TAM), and any significant milestones.

These metrics help investors quickly see your startup’s potential and performance.

How can I leverage email analytics to improve investor engagement?

Track open rates, click-through rates, and response rates to improve engagement. Use A/B testing to refine your subject lines and content. Find the best times to send emails for more engagement.

Develop a follow-up plan based on these insights. Use automation tools to streamline outreach while keeping it personal.

What are some effective ways to incorporate social proof in cold emails?

Mention notable clients or partners, media coverage, and industry awards to show social proof. Share positive testimonials and successful pilot programs or case studies. If you’ve received funding from reputable investors, mention it to boost credibility.

How should I structure equity and prepare term sheets for potential investors?

When structuring equity, consider valuation, equity stake, and liquidation preferences. Create a clear capitalization table. Prepare a term sheet with key deal terms, including investment amount and investor rights.

Work with a lawyer experienced in startup financing to ensure your documents are correct.

What are some best practices for follow-up emails in the fundraising process?

Be persistent but respectful in your follow-ups. Add value with each email, personalizing your messages and keeping a professional tone. Time your follow-ups right, usually 3-5 business days apart.

Keep track of your interactions and tailor your approach based on the investor’s response.

How can I effectively communicate my startup’s growth potential in a cold email?

Highlight key metrics that show traction and scalability. Mention your growth rate, market size, customer acquisition efficiency, and any partnerships or expansions. Use data visualizations to show your projections.

Clearly explain your competitive advantage and go-to-market strategy to investors.