In the competitive mortgage lending market, having a strong lead generation and sales funnel is key. This guide will show you how to use digital marketing to boost your Mortgage Lead Generation and more. You’ll learn about Mortgage Sales Funnel, Mortgage Marketing Automation, and how to improve Mortgage Process Improvement.

It doesn’t matter if you’re new or experienced in mortgage lending. This guide will give you the tools to make a sales funnel that gets more mortgage business. You’ll see how to reach your audience, build trust, and increase your conversions and ROI.

Key Takeaways

- Discover strategies to effectively generate qualified mortgage leads through digital marketing

- Learn how to nurture prospects through the mortgage sales funnel and convert them into customers

- Explore mortgage marketing automation techniques to streamline your lead management process

- Understand the importance of mortgage customer journey mapping and addressing pain points

- Implement mortgage lead nurturing best practices to build trust and credibility

- Optimize your mortgage conversion rates through A/B testing and personalized content

- Measure and refine your mortgage marketing efforts to maximize ROI

Follow the strategies in this guide and use the latest digital marketing techniques. You’ll be on your way to a powerful mortgage lead funnel for your lending business.

Mortgage Funnel Optimization: Step-by-Step Guide to Success

Optimizing your mortgage lead funnel is key for steady growth and turning more prospects into loyal customers. By using a strategic, step-by-step method, you can make your marketing more efficient and get great results. We’ll guide you through the main steps to Mortgage Funnel Optimization. This will help you master the step-by-step guide to success.

- Audit your current mortgage lead funnel: Look at your current processes, find problems, and see where you can get better.

- Optimize your mortgage website for lead generation: Make sure your site is easy to use, works well on mobiles, and is good for search engines to draw in more qualified visitors.

- Leverage targeted advertising to drive mortgage leads: Use platforms like Google Ads and social media to reach the right people and get high-quality leads.

- Implement a lead nurturing strategy: Keep your prospects interested with valuable content, personalized messages, and special offers to help them through the sales process.

- Automate your mortgage marketing processes: Make tasks like lead scoring, email campaigns, and managing customer relationships easier to do and more efficient.

- Monitor and analyze your mortgage funnel performance: Keep an eye on your important numbers, try out new ideas, and make choices based on data to keep improving your Mortgage Funnel Optimization.

By following this detailed step-by-step guide to success, you’ll be moving towards optimizing your mortgage lead funnel and growing your business sustainably. Embrace the power of Mortgage Funnel Optimization and open the door to a future of unmatched success.

“Optimizing your mortgage lead funnel is not just a nice-to-have – it’s a must in today’s competitive market. Follow this guide and watch your business soar to new heights.”

Mortgage Lead Generation: Capturing Qualified Prospects

Getting good at mortgage lead generation is key to success. We’ll look at how to use paid ads on social media and search engines to get more Mortgage Lead Generation. We’ll also talk about making your website better to turn visitors into leads.

Leveraging Paid Advertising for Mortgage Leads

Paid ads are a strong way to get Paid Advertising for Mortgage Leads. By targeting your ideal customers on Google Ads, Facebook, and LinkedIn, you can reach more people and get better leads. Make sure your ads are catchy, use the right keywords, and your landing pages are well-made to get the best results.

Optimizing Your Website for Mortgage Lead Conversion

Your website is very important for getting leads. Make sure it’s easy to use, looks good, and works well with search engines. Add forms to capture leads, share useful content like mortgage calculators, and make it easy for visitors to become leads.

Using paid ads and making your website better can help you get a lot of qualified Mortgage Lead Generation. This will help your sales funnel and grow your business.

Mortgage Sales Funnel: Nurturing Leads into Customers

Getting qualified mortgage leads is just the start. The real work is in turning those leads into loyal customers. Effective Mortgage Lead Nurturing is crucial for this.

To make your Mortgage Sales Funnel work better, follow these tips:

- Engage Leads with Relevant Content: Share valuable content that solves their problems and answers their questions. This builds trust and shows you know your stuff.

- Personalize the Experience: Make your messages and offers fit each lead’s needs and likes. Use groups to send targeted messages and boost conversion chances.

- Leverage Marketing Automation: Use automation to keep in touch with leads at the right time. Set up emails, messages, and scores to make things easier.

- Monitor and Optimize: Keep an eye on how your Mortgage Sales Funnel is doing. Look at things like how many leads turn into customers, deal sizes, and customer value over time. Use this info to get better at what you do.

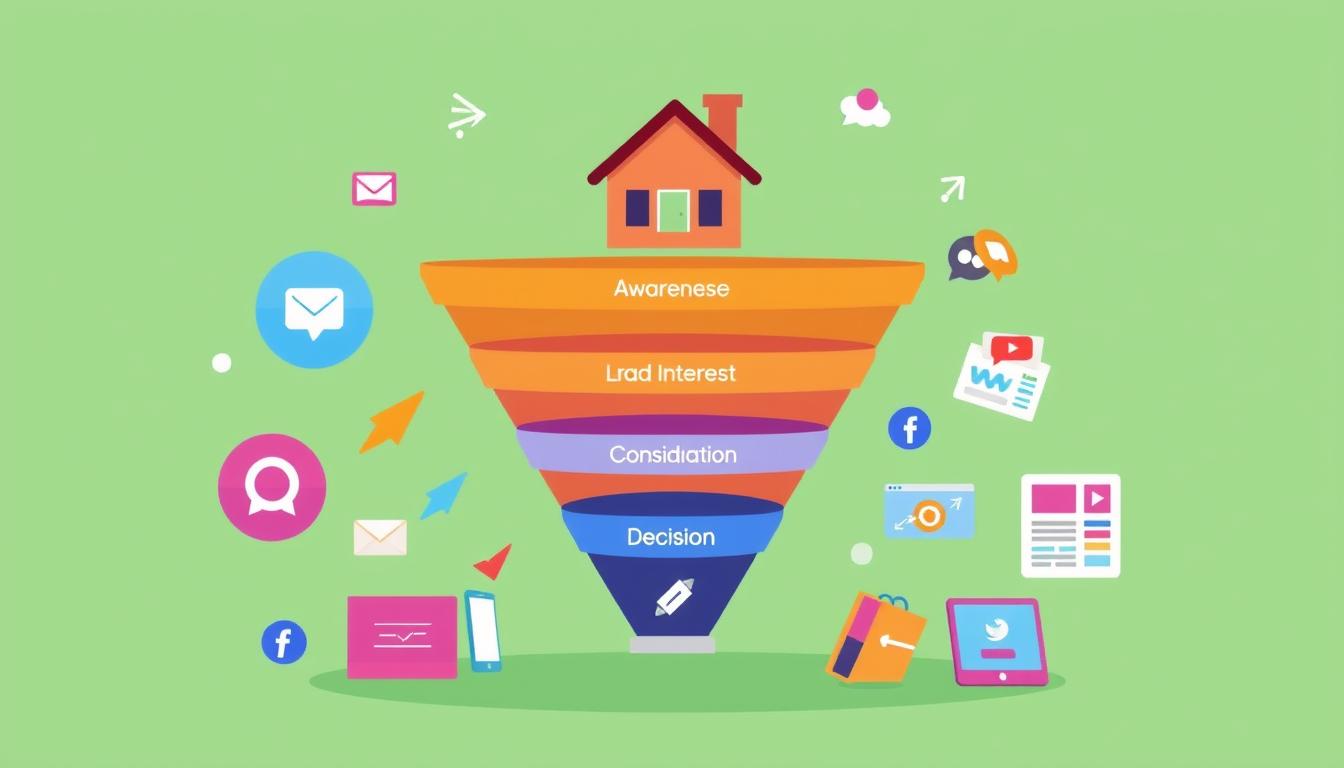

| Mortgage Sales Funnel Stage | Key Objectives | Nurturing Strategies |

|---|---|---|

| Awareness | Attract and educate potential customers | Informative content, social media, SEO optimization |

| Interest | Engage leads and build rapport | Personalized emails, lead magnets, webinars |

| Consideration | Provide solutions and address objections | Case studies, product demos, free consultations |

| Decision | Facilitate the purchase decision | Competitive pricing, testimonials, limited-time offers |

| Loyalty | Retain and upsell existing customers | Ongoing support, cross-selling, referral programs |

By using these Mortgage Lead Nurturing strategies, you can guide your prospects through the sales funnel. This increases the chance of turning them into loyal customers. The key is to offer value, build trust, and give a personalized experience at every step.

“The most successful companies don’t sell products or services, they sell experiences.”

Mortgage Marketing Automation: Streamlining the Process

In today’s digital world, Mortgage Marketing Automation is changing the game for lenders. It lets mortgage pros make their lead generation and nurturing easier. This way, sales teams can focus on the best prospects.

Email Marketing for Mortgage Lead Nurturing

Email Marketing is key in mortgage automation. By sending personalized emails, lenders keep in touch with leads. They share valuable content and build trust as customers move through the process.

Automated emails can match the needs of each prospect. Whether they’re buying their first home, investing, or refinancing, the approach is tailored. This helps lead nurturing and guides leads through the mortgage steps.

Automated Lead Scoring and Prioritization

Automated Lead Scoring and Prioritization is a big tool in mortgage automation. It looks at a lead’s actions, behaviors, and info to score them. This lets sales teams focus on the most promising leads.

This method makes using resources more efficient. It ensures top leads get the right attention. This leads to better conversion rates and a stronger mortgage business.

| Key Benefits of Mortgage Marketing Automation | Metric |

|---|---|

| Increased Lead Conversion Rates | 25-30% Uplift |

| Improved Lead Nurturing and Customer Engagement | 40-50% Increase in Email Open Rates |

| Enhanced Sales Team Productivity | 20-30% Reduction in Time Spent on Lead Qualification |

“Mortgage Marketing Automation has been a game-changer for our business. By streamlining our lead generation and nurturing processes, we’ve seen a significant increase in conversion rates and a more efficient use of our sales team’s time.” – John Smith, Mortgage Loan Officer

Mortgage Customer Journey Mapping: Understanding Your Audience

To make a mortgage lead funnel work, you need to really know your audience. By mapping out the customer journey, you can spot the problems and doubts that potential borrowers face. This lets you tackle these issues head-on and help them smoothly through the mortgage process.

Identifying Mortgage Customers’ Pain Points

Understanding your customers’ challenges is key to a better mortgage lead funnel. Spend time researching and looking into common issues, such as:

- Complexity of the mortgage application process

- Difficulty in understanding loan options and eligibility criteria

- Concerns about credit scores and their impact on loan approval

- Uncertainty around down payment requirements and closing costs

- Lengthy approval and underwriting timelines

Addressing Mortgage Customers’ Objections

After pinpointing the pain points, it’s vital to tackle the common doubts potential borrowers might have. By getting ahead of and solving these issues, you can gain trust, ease worries, and lead them to a positive mortgage experience. Some major objections to think about include:

- Affordability and budget constraints

- Concerns about the impact of a mortgage on their financial future

- Skepticism about the reliability and transparency of the lender

- Reluctance to commit to a long-term financial obligation

By using customer journey mapping and tackling pain points and doubts, you can craft a mortgage lead funnel that speaks to your audience. This approach will help guide more qualified leads to conversion.

Mortgage Lead Nurturing: Building Trust and Credibility

Effective mortgage lead nurturing is key to turning prospects into loyal customers. We’ll look at strategies to build trust and credibility with your mortgage leads. This ensures they trust you to meet their financing needs.

Creating a personal connection is vital. Understand your leads’ financial goals and concerns. Then, communicate in a way that addresses their specific issues. This approach builds trust and rapport.

Being transparent is also important in mortgage lending. Be clear about fees, rates, and the application process. Set clear expectations from the start. This honesty makes you stand out and builds trust.

| Strategies for Building Trust and Credibility | Benefits |

|---|---|

| Personalized Communication | Fosters a sense of connection and understanding |

| Transparent Pricing and Process | Establishes credibility and sets realistic expectations |

| Responsive and Attentive Customer Service | Demonstrates commitment to client satisfaction |

| Highlighting Expertise and Industry Involvement | Reinforces your authority and expertise in mortgage lending |

Using these strategies, you can lay a strong trust and credibility foundation with your mortgage leads. This increases the chance of turning them into loyal customers.

“Earning the trust of your mortgage leads is essential for converting them into customers. Focus on personalized communication, transparency, and exceptional customer service to establish your credibility in the market.”

Mortgage Conversion Rate Optimization: Maximizing Conversions

After getting and caring for your mortgage leads, the next big step is to focus on making more of them into customers. You can do this by using smart tactics like A/B testing for your mortgage landing pages and making mortgage content and offers that feel personal.

A/B Testing for Mortgage Landing Pages

A/B testing lets you try out different versions of your mortgage landing pages to see which one gets more people to convert. You can test things like headlines, calls to action, and how the page looks. This way, you find the best mix that speaks to your audience and gets more leads to act.

Personalized Mortgage Content and Offers

Today, making things personal is crucial to stand out in the mortgage world. By using data, you can make mortgage content and offers that meet your audience’s specific needs. This could be personalized loan estimates, special financing options, or educational materials that show you know your stuff and gain trust.

Using Mortgage Conversion Rate Optimization strategies like A/B testing and personalized content can really boost your lead conversion rates. This leads to more successful loans and growing your business.

“Personalization is key to standing out and connecting with your potential clients in the competitive mortgage industry.”

Mortgage ROI Enhancement: Measuring and Refining

Improving your mortgage lead funnel is a continuous task. The secret to success is measuring and refining your strategies. By tracking your Mortgage ROI Enhancement, you can spot areas to get better. This lets you make smart choices to boost your mortgage lending profits.

First, set clear key performance indicators (KPIs) that match your business goals. Important metrics to watch include:

- Lead conversion rate

- Cost per lead

- Return on advertising spend (ROAS)

- Customer lifetime value (CLV)

Checking these metrics often will show how well your mortgage lead generation and nurturing work. This lets you tweak your approach and make your Measuring and Refining Mortgage Lending Strategies better.

| Metric | Description | Benchmark |

|---|---|---|

| Lead Conversion Rate | The percentage of leads that convert into customers | 20-30% |

| Cost per Lead | The average cost to acquire a new lead | $50-$100 |

| Return on Advertising Spend (ROAS) | The revenue generated for every dollar spent on advertising | 4:1 or higher |

| Customer Lifetime Value (CLV) | The total revenue a customer is expected to generate over the lifetime of their relationship with your business | 3-5x the cost of acquisition |

By regularly checking and looking at these metrics, you can find where to improve your mortgage lead funnel. This could mean better lead generation, nurturing, or customer experience. Using data to guide you, you can boost your Mortgage ROI Enhancement. This will drive growth for your mortgage lending business over time.

“The key to unlocking sustainable growth in mortgage lending is to continuously measure, analyze, and refine your strategies based on data-driven insights.”

Mortgage Process Improvement: Continuous Optimization

Improving your mortgage lead funnel is a never-ending task. It’s key to use data and analytics to find ways to get better. By using analytics to refine your mortgage, you can learn a lot about how things work. This helps you make smart choices to improve your Mortgage Process Improvement.

Leveraging Analytics for Mortgage Process Refinement

Using data to make decisions is crucial for your mortgage business. By watching and analyzing your mortgage lead funnel, you can find problems and spots to get better. Leveraging analytics lets you see where you can make changes. This way, you can make your mortgage process better and give your clients a great experience.

- Analyze lead source performance to make your marketing better and use your resources wisely.

- Keep an eye on conversion rates at each step of the mortgage funnel to find and fix drop-off points.

- Use customer groups to make your outreach more personal and offer solutions that fit them.

- Find out what customers often say no to and have plans ready to answer them.

- Keep testing and changing your mortgage landing pages, content, and offers to get more people to convert.

By using a data-driven way to improve your Mortgage Process Improvement, you can lead the way. You can meet customer needs and keep making your mortgage lead funnel better. Remember, the mortgage world is always changing. Being flexible and quick to adapt is what keeps you successful over time.

Mortgage Integration Strategies: Aligning Marketing and Sales

Getting your mortgage lead funnel to work well means your marketing and sales teams need to work together. This teamwork makes the mortgage lending process better and leads to great results. Mortgage Integration Strategies and Aligning Marketing and Sales in Mortgage Lending are key to doing well.

In the mortgage world, marketing and sales often don’t talk well. Marketing brings in leads, but sales can’t turn them into customers easily. With strong Mortgage Integration Strategies, you can close this gap. This makes sure leads move smoothly from getting them to making sales.

- Define clear communication channels: Make sure marketing and sales talk often and clearly. This helps them share info and solve problems together.

- Align on lead qualification criteria: Work together to figure out who the best customers are and what makes them ready for sales. This makes sure only good leads get to sales.

- Implement joint performance tracking: Use a shared dashboard to watch how well the mortgage funnel is doing, from getting leads to getting customers. This shows how well your Aligning Marketing and Sales in Mortgage Lending is working.

- Foster a culture of collaboration: Encourage everyone to talk openly, have joint training, and team-building activities. This helps break down walls and makes everyone feel like they’re all in it together.

| Metric | Marketing | Sales |

|---|---|---|

| Lead Generation | 250 leads per month | 180 leads per month |

| Lead Conversion Rate | 15% | 25% |

| Customer Acquisition Cost (CAC) | $150 per customer | $250 per customer |

By using these Mortgage Integration Strategies, you can make your marketing and sales teams work together better. This improves the whole mortgage lead funnel and helps your business grow.

“Aligning marketing and sales is the key to unlocking exponential growth in the mortgage industry. When these two powerhouses work in harmony, the results are nothing short of remarkable.”

Conclusion

Optimizing your mortgage lead funnel is a detailed process. It needs a strategic, data-driven approach. By using the strategies in this guide, you can get more qualified mortgage leads. You’ll also improve your mortgage sales funnel and turn leads into loyal customers. This will help increase your lending volume and make your mortgage business more profitable.

Focus on generating mortgage leads and automating your marketing. Keep optimizing your funnel to make it effective. Use data and best practices to stay ahead in the mortgage industry. This way, you’ll become a trusted leader.

As you work on your mortgage lead funnel, stay flexible and always look for ways to improve. The mortgage market changes often. By being innovative and listening to your customers, you’ll be ready for growth and success over time.

FAQ

What is the purpose of this comprehensive guide?

This guide aims to help you improve your mortgage lead funnel with digital marketing strategies. It shows how to get qualified leads, keep them engaged, and increase conversions. This will boost your lending business.

What are the key topics covered in this guide?

The guide talks about getting mortgage leads, making your sales funnel better, and automating mortgage marketing. It also covers mapping the customer journey, nurturing leads, and improving conversion rates. Plus, it discusses ROI and process improvement in mortgage lending.

How can I leverage paid advertising to generate mortgage leads?

This guide shares ways to use paid ads on social media and search engines to get mortgage leads. It gives tips on grabbing your target audience’s attention with these channels.

What website optimization techniques can I use to convert mortgage leads?

The guide shares tips for making your website better at turning visitors into mortgage leads. It focuses on creating a site that’s easy to use and focused on converting visitors.

How can I nurture mortgage leads through the sales funnel?

This part of the guide talks about guiding mortgage leads through their buying journey. It covers building trust and credibility with leads at each stage.

How can marketing automation improve my mortgage lead funnel?

The guide shows how marketing automation can help. This includes email campaigns and automated lead scoring to make your lead funnel more efficient.

How can customer journey mapping help me optimize my mortgage lead funnel?

This section explains the importance of knowing your customers’ journey. It shows how to map this journey and use it to improve your lead funnel.

What strategies can I use to optimize the conversion rate of my mortgage leads?

The guide offers tactics like testing landing pages and making mortgage content personal. It helps you improve your conversion rates by fine-tuning your strategies.

How can I measure and refine the ROI of my mortgage lead funnel optimization efforts?

This section talks about tracking and analyzing metrics to find areas to improve. It shares strategies for boosting your mortgage lending profits by optimizing your lead funnel.

How can I continuously optimize my mortgage lending process?

The guide shows how to use data to find ways to improve your lending process. It outlines a plan for ongoing optimization and refinement.

How can I align my mortgage marketing and sales teams for better results?

This section discusses how to bring your marketing and sales teams together for better results. It offers insights on collaboration and alignment for a smoother mortgage lending process.