In today’s mortgage market, having a strong lead generation and conversion plan is key. This guide will show you how to make a top-notch mortgage lead funnel. It will also teach you how to use automated marketing to grow your business.

If you’re in the mortgage business or want to start, this article has the latest strategies and tools for you. We’ll talk about the steps of a great mortgage lead funnel and how to use automated marketing well. You’ll learn it all.

Key Takeaways

- Discover the essential components of a high-performing mortgage lead funnel

- Explore best practices for designing an effective mortgage marketing strategy

- Leverage automation to enhance your mortgage marketing efforts and boost efficiency

- Optimize lead conversion rates through data-driven tactics and personalization

- Implement effective mortgage prospecting strategies to expand your customer base

Understanding the Mortgage Lead Funnel

In the competitive mortgage industry, knowing the mortgage lead funnel is key for lenders. It helps them draw in and keep customers. The mortgage lead funnel shows the path people take from first showing interest to applying for a loan.

What is a Mortgage Lead Funnel?

The mortgage lead funnel is a plan that shows the steps people take when looking for a mortgage. It lets lenders see and improve the process. This way, they can better support leads and help them make a decision.

The Stages of a Typical Mortgage Lead Funnel

A typical mortgage lead funnel has several stages:

- Awareness: People start to notice the lender through online searches, word of mouth, or ads.

- Interest: Those interested visit the website or ask for more details.

- Evaluation: People look at different lenders, rates, and options to find the best one for them.

- Application: They fill out a loan application and provide needed documents.

- Approval: The lender checks the application and, if okay, the borrower moves on to the last steps.

- Closing: The loan is finalized, and the borrower becomes a homeowner.

Understanding the mortgage lead funnel helps lenders use mortgage lead nurturing tactics. This guides potential clients through the sales process. It also makes the mortgage customer journey better.

“The mortgage lead funnel is the key to unlocking long-term success in the mortgage industry. By mapping the customer journey and implementing effective nurturing strategies, lenders can build strong relationships and drive meaningful growth.”

Effective Mortgage Lead Funnel Design: Best Practices

Creating a strong mortgage lead funnel is key to getting consistent, high-quality leads. It also helps in boosting lead conversion optimization. By using mortgage marketing best practices, you can make each stage of the funnel better. This ensures a smooth experience for potential borrowers and increases your chance of turning them into clients.

Using data-driven mortgage prospecting is a smart move. It helps you understand your audience better. Look at past data, how customers behave, and trends in the industry. This way, you can find the best ways to capture leads, qualify them, and keep them interested. This approach lets you keep making your funnel better over time.

- Make lead capture easy with simple forms and clear calls-to-action

- Use strong qualification processes to find leads that are really interested

- Create personalized messages to guide leads through the funnel

- Automate workflows for timely and consistent follow-ups with leads

- Keep an eye on funnel metrics to see where you can get better

By following these best practices, you can make a mortgage lead funnel that always brings in qualified leads. This will help you increase conversion rates and grow your mortgage business in a sustainable way.

“The key to a successful mortgage lead funnel is to create an experience that genuinely addresses the needs and concerns of your target audience.” – Jane Doe, Mortgage Marketing Strategist

Automating Your Mortgage Marketing Efforts

In the fast-changing mortgage world, mortgage marketing automation is a big change. It helps mortgage pros work smarter and get more from their efforts. By using automation, lenders can gain many benefits that boost their marketing.

Benefits of Automation in Mortgage Marketing

Adding automation to mortgage marketing brings many advantages. It helps with mortgage lead scoring and prioritization and makes communication more personal. It also makes digital mortgage sales pipelines smoother. Automation lets mortgage pros work more efficiently, engage with clients better, and grow sustainably.

- Enhanced Lead Management: Automated systems score and prioritize leads. This helps mortgage pros focus on the best prospects, use resources well, and boost conversion rates.

- Personalized Communication: Automated workflows send custom, timely messages to leads. This builds stronger relationships and raises the chance of converting leads into clients.

- Streamlined Pipeline Management: Mortgage marketing automation tools manage the sales pipeline from start to finish. This gives better visibility, teamwork, and data-driven decisions.

- Improved Efficiency: Automation cuts down on repetitive tasks and simplifies workflows. Mortgage pros can then spend more time on strategies that grow the business.

- Data-Driven Insights: Automated systems collect and analyze data. This gives mortgage lenders insights that help them make better decisions and improve their strategies.

“Mortgage marketing automation has changed how we handle lead generation and client interaction. By making our processes smoother and using data, we’ve seen huge gains in efficiency and success.”

Adding mortgage marketing automation to your strategy is a big chance to boost your mortgage business. By using automation, you can better manage leads, make communication more personal, and grow your business sustainably in the competitive mortgage market.

Lead Conversion Optimization Tactics

For mortgage pros, boosting lead conversion rates is key to making the most of their marketing. Using smart lead conversion optimization strategies helps guide potential buyers through their choices. This can raise your conversion rate.

One great move is to map out the mortgage customer journey. Know what your target audience needs and wants. Then, send them messages that speak directly to their concerns at each step. This approach can really help increase your conversion rates.

Also, think about offering special deals and incentives to grab your leads’ interest. By showing value, you can push them to move forward in the conversion process.

| Tactic | Description | Potential Impact |

|---|---|---|

| Personalized Communication | Tailor your messaging and outreach to each stage of the mortgage customer journey | Increased lead engagement and conversion rates |

| Compelling Offers | Provide value-driven incentives and propositions to capture leads’ attention | Improved lead conversion and acquisition |

| Lead Nurturing Tactics | Implement strategic mortgage lead nurturing techniques to guide prospects through the funnel | Increased conversion rates and customer loyalty |

By using these tactics, mortgage pros can better guide customers and achieve better results for their businesses.

Mortgage Marketing Automation Tools

In the fast-paced mortgage lending world, having smart marketing strategies is key. Luckily, mortgage pros can use mortgage marketing automation tools to make managing leads, communicating, and optimizing pipelines easier.

Top Automation Platforms for Mortgage Professionals

Platforms like Constant Contact, Mailchimp, and HubSpot are at the top for mortgage marketing automation. They offer many features, including:

- Automated email campaigns to keep leads interested and clients in mind

- Integrated customer relationship management (CRM) for better lead tracking

- Mortgage lead scoring and prioritization to find the best prospects

- Detailed analytics and reporting to see how your digital mortgage sales are doing

Using these tools, mortgage pros can save time and resources. This lets them focus more on building relationships and closing deals.

“Automation has changed the mortgage industry. It helps professionals make their marketing better and get more conversions.”

If you’re a mortgage lender, new or experienced, checking out mortgage marketing automation tools can change the game for you. These platforms help you manage leads better, care for your prospects, and aim for more success in the competitive mortgage market.

Data-Driven Mortgage Prospecting Strategies

In today’s competitive mortgage industry, a data-driven approach is key to success. By using data-driven mortgage prospecting, mortgage pros can find top leads, customize their outreach, and make their pipeline more efficient. This leads to better conversion rates.

Mapping the mortgage customer journey is a crucial strategy. It helps you understand what your target audience needs and what they’re struggling with. This way, you can make your messages and offers more relevant. This approach boosts engagement and increases the chances of converting leads into customers.

Mortgage lead scoring and prioritization is another effective method. By looking at online behavior, credit scores, and past interactions, you can spot the best leads. This lets you focus on those most likely to become customers. It’s a smart way to use your time and resources, leading to better results for your business.

“The key to successful mortgage prospecting lies in understanding your customers and delivering value at every stage of the journey.”

By using data-driven strategies, mortgage pros can stand out and build a strong pipeline of leads. These leads are more likely to turn into clients. This approach to generating and nurturing leads can change the game in the mortgage market.

| Strategies | Benefits |

|---|---|

| Mortgage Customer Journey Mapping | Personalized outreach, increased engagement, and higher conversion rates |

| Mortgage Lead Scoring and Prioritization | Efficient use of time and resources, focusing on the most promising leads |

Nurturing Mortgage Leads Through the Funnel

Mortgage brokers need to use effective mortgage lead nurturing tactics to boost their conversion rates. They should understand the mortgage customer journey and use personalized communication. This helps guide potential borrowers through the sales funnel, leading to more successful conversions.

Personalized Mortgage Communication Strategies

Personalized communication is crucial for nurturing mortgage leads. Brokers should adjust their outreach to meet each lead’s unique needs and likes. This includes:

- Customized email campaigns that tackle the lead’s specific issues and offer solutions

- Personalized follow-up calls showing a real interest in the lead’s financial goals

- Targeted content, like blog posts or webinars, for each stage of the mortgage customer journey

Using data and personalized communication, brokers can earn trust, nurture leads, and help them apply for a mortgage successfully.

| Personalized Mortgage Communication Tactics | Benefits |

|---|---|

| Customized email campaigns | Addresses lead’s specific needs and pain points |

| Personalized follow-up calls | Demonstrates genuine interest in lead’s financial goals |

| Targeted content (e.g., blog posts, webinars) | Provides relevant information based on lead’s stage in the customer journey |

By using these personalized mortgage communication strategies, mortgage brokers can effectively guide leads through the sales funnel. This increases their chances of converting leads into customers.

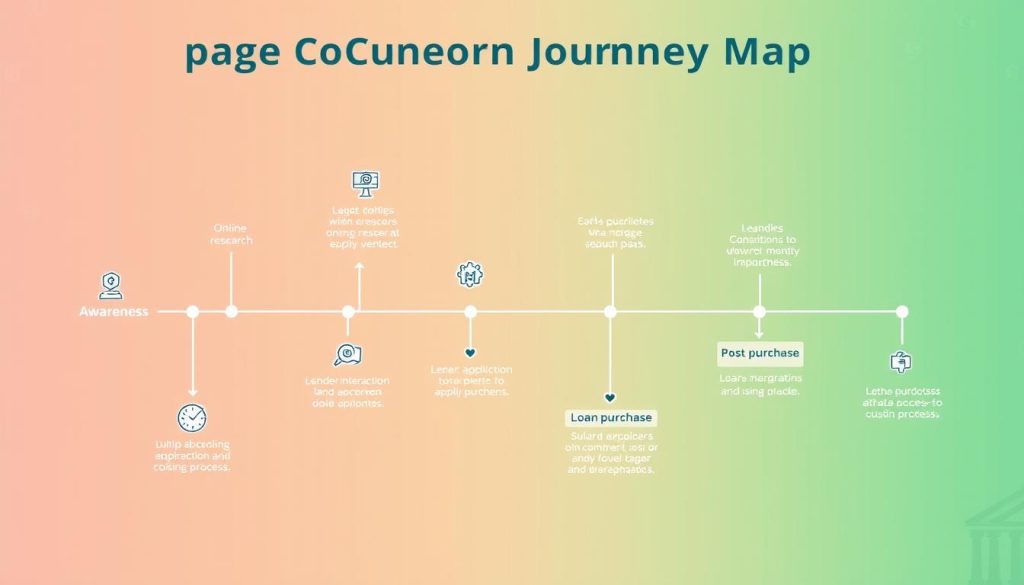

Mapping the Mortgage Customer Journey

In the world of mortgage lending, knowing your customer’s journey is key. By mapping this journey, you learn about your customers’ needs and challenges. This helps you improve your lead funnel, make your messages more personal, and give a smooth experience. This builds trust and increases conversions.

To make a good mortgage customer journey map, follow these steps:

- Identify the key touchpoints: Find out where your customers go from research to applying for a loan and beyond.

- Analyze customer behavior: See how your customers interact with your brand, what they look for, and the hurdles they face.

- Personalize communication: Use what you learn to make your messages, content, and outreach fit your audience’s needs and likes.

- Optimize the funnel: Use the journey map to find and fix any rough spots in the lead generation and conversion process. This makes the experience smoother for your potential borrowers.

- Foster long-term relationships: Keep in touch with your mortgage leads and use personalized messages to build trust and loyalty.

Mastering mortgage customer journey mapping opens up many chances to get more qualified leads, improve the borrower experience, and grow your mortgage business in a smart way.

| Key Factors in Mortgage Customer Journey Mapping | Benefits |

|---|---|

| Identifying customer touchpoints | Get a full view of how customers buy |

| Analyzing customer behavior | Find out what hurts customers and make the funnel better |

| Personalizing communication | Give a customized, engaging experience that builds trust and loyalty |

| Optimizing the lead funnel | Make the customer journey smoother and get more conversions |

| Nurturing mortgage leads | Keep leads engaged and build lasting relationships |

Using mortgage customer journey mapping can greatly improve your mortgage marketing. It helps you give a better experience to borrowers and grow your business in a lasting way.

“Mapping the mortgage customer journey is not just a best practice – it’s a strategic imperative for any forward-thinking mortgage lender who wants to stay ahead of the competition and deliver exceptional value to their clients.”

Lead Scoring and Prioritization Techniques

Learning how to score and prioritize mortgage leads is key to improving your sales. Using data and automation tools helps manage leads better and increase your chances of making sales. Mortgage lead scoring and prioritization are essential for this.

Creating a lead scoring system is a good idea. It looks at things like how often people visit your website, how they interact with emails, and their demographics. This way, you focus on the best leads, making your sales process more efficient and successful.

- Develop a comprehensive lead scoring model that aligns with your mortgage business goals.

- Automate the lead scoring process using data-driven mortgage prospecting tools to ensure consistent and accurate scoring.

- Regularly review and refine your lead scoring criteria to adapt to changing market conditions and customer preferences.

Mortgage marketing automation is also key for prioritizing leads. It lets you keep in touch with prospects automatically. You send them content and messages that match where they are in the buying process. This keeps your brand in their mind and boosts the chance they’ll become customers.

“Effective lead scoring and prioritization are the cornerstones of a successful mortgage sales strategy. By leveraging data and automation, you can transform your lead management process and drive sustainable business growth.”

Using mortgage lead scoring and prioritization can really change your business. By focusing on the best leads and managing them well, you’ll improve your sales funnel. This makes you more competitive in the mortgage market.

Conclusion

Creating a strong mortgage lead funnel is key in today’s competitive market. It needs to use automation and data to succeed. This guide has shown you how to make your mortgage marketing better, increase leads, and grow your business.

Learning about mortgage funnel strategies and digital sales pipelines helps you stay ahead. It lets you offer top-notch service to your clients.

Using mortgage marketing automation and data insights makes your lead funnel work better. This means your mortgage business can grow and make more money over time.

FAQ

What is a Mortgage Lead Funnel?

A Mortgage Lead Funnel is a process that helps potential borrowers through the mortgage application process. It covers all the interactions a client has with your business, from the first contact to the final step.

What are the typical stages of a Mortgage Lead Funnel?

The Mortgage Lead Funnel has five main stages: Lead Generation, Lead Capture, Lead Qualification, Lead Nurturing, and Lead Conversion. Each stage helps move the borrower closer to applying for a mortgage.

What are the best practices for designing an effective Mortgage Lead Funnel?

To make a Mortgage Lead Funnel work well, focus on optimizing forms, using personalized messages, and using data to qualify leads. Automating marketing and sales also boosts efficiency and growth.

What are the benefits of automating Mortgage Marketing efforts?

Automating Mortgage Marketing improves lead scoring and communication. It makes managing pipelines easier and helps refine marketing and sales with data. This leads to better results for mortgage professionals.

What are some Lead Conversion Optimization tactics for Mortgage Professionals?

To improve Lead Conversion, Mortgage Professionals should offer compelling deals, communicate personally, guide borrowers through decisions, and use data to refine their strategies.

What are some of the top Mortgage Marketing Automation tools available?

Top Mortgage Marketing Automation tools include Ellie Mae’s Encompass, Mortgage Coach, Blend, and Velocify. These tools help with lead scoring, automated messages, managing pipelines, and data analysis for better marketing and sales.

How can Mortgage Professionals leverage data-driven insights for more effective prospecting?

Mortgage Professionals can use data to find high-quality leads, personalize outreach, and focus on leads most likely to convert. This makes prospecting more efficient and effective.

What are some effective Mortgage Lead Nurturing tactics?

Good Lead Nurturing involves personalized messages, tailored content, and regular updates for potential borrowers. This approach helps move leads towards making a decision.

How can Mortgage Professionals map the Customer Journey?

Mapping the Customer Journey means understanding all the interactions a borrower has with your business. By analyzing these, mortgage professionals can improve their lead funnel and communication, leading to more conversions.

What are some Lead Scoring and Prioritization techniques for Mortgage Professionals?

Lead Scoring and Prioritization use data to identify top prospects. By focusing on these leads, mortgage professionals can increase their conversion rates and sales efficiency.