In today’s mortgage market, having a strong lead funnel and using automated marketing is key. It’s vital for boosting conversions and growing your business. Whether you’re a mortgage broker, lender, or real estate pro, getting good at generating, nurturing, and converting leads is crucial.

This guide will cover everything you need to build a mortgage lead funnel. We’ll go from understanding the mortgage customer journey to making your marketing campaigns work better.

Key Takeaways

- Understand the importance of creating a conversion-driven mortgage lead funnel

- Learn how to map out the mortgage customer journey and align your funnel stages

- Discover effective mortgage lead generation tactics, including leveraging lead magnets

- Explore strategies for nurturing mortgage leads with automated workflows

- Optimize your mortgage marketing funnels for maximum conversion

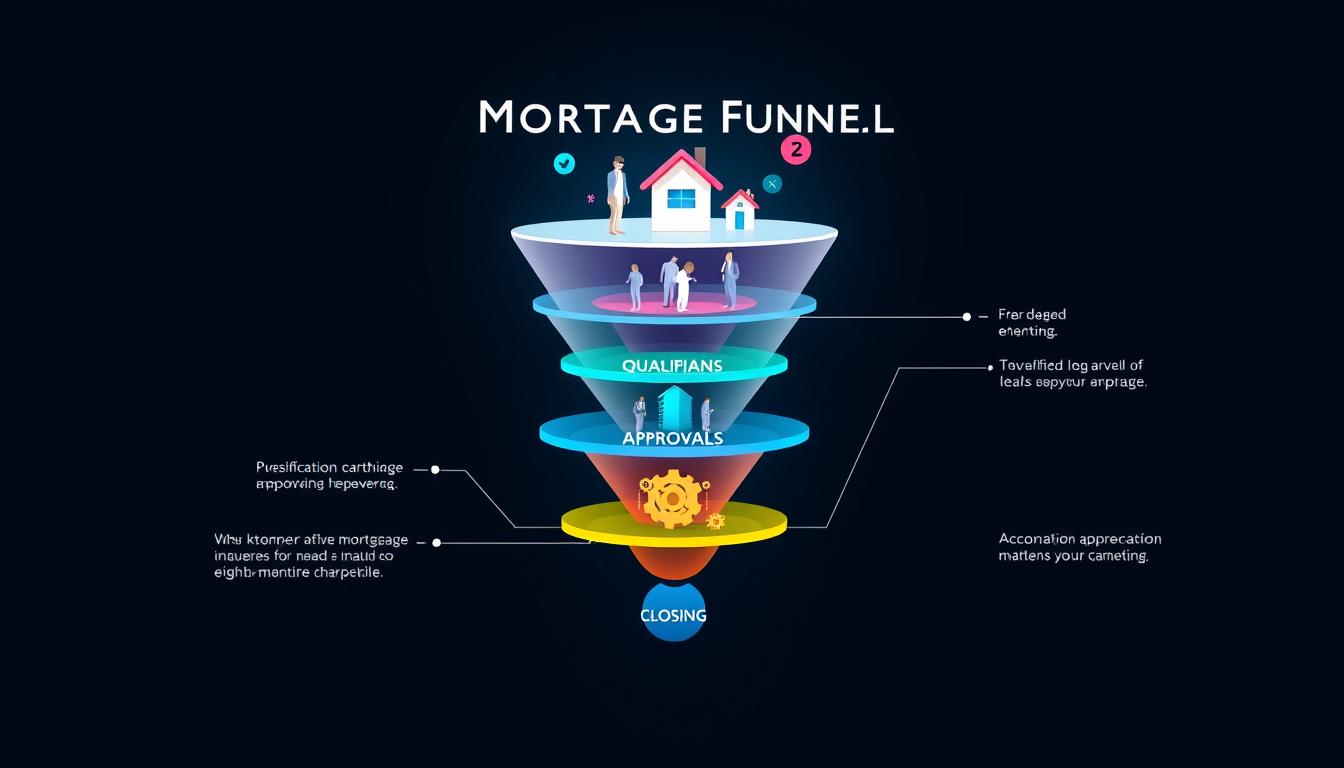

Creating a Mortgage Funnel That Maximizes Conversions

Crafting an effective mortgage lead funnel is key for boosting conversions and expanding your lending business. It starts with understanding the mortgage customer journey. By mapping out the steps potential borrowers take, you can make your funnel better. This leads them smoothly to a successful loan application.

Understanding the Mortgage Customer Journey

The mortgage customer journey covers the steps from initial research to final loan approval. It includes awareness, consideration, application, and the closing of the deal. Knowing the unique needs and pain points of your audience helps you create marketing strategies. These strategies address their concerns and lead them to a positive outcome.

Mapping Out Your Mortgage Funnel Stages

With a clear view of the mortgage customer journey, it’s time to map out your funnel stages. These stages include:

- Lead Generation: Attracting potential borrowers through content marketing, digital ads, and referrals.

- Lead Nurturing: Engaging and educating leads with personalized messages, email campaigns, and valuable content.

- Application Submission: Helping leads through the application process, offering support, and addressing concerns.

- Closing the Deal: Ensuring a smooth transaction and keeping a good relationship with new clients.

By carefully mapping each stage of the mortgage funnel, you can spot bottlenecks, improve touchpoints, and create a customer-focused experience. This leads to higher conversion rates.

Having a well-designed mortgage lead funnel that meets your audience’s needs is vital. It’s a key step in boosting conversions and growing your lending business.

Mortgage Lead Generation: Attracting Qualified Prospects

In the mortgage industry, mortgage lead generation is key to success. As a mortgage pro, drawing in qualified prospects is vital for your business growth. Using mortgage lead magnets is a smart strategy.

Leveraging Mortgage Lead Magnets

Lead magnets are valuable resources you offer for contact info. They can be:

- Downloadable guides on navigating the mortgage process

- Checklists for first-time homebuyers

- Personalized mortgage rate calculators

- Webinars or video content on mortgage-related topics

These magnets grab your target audience’s attention. They help you build a list of qualified mortgage leads.

Optimizing Your Mortgage Website for Lead Capture

Improving your mortgage website is key for mortgage lead generation. Make sure it’s easy to use, looks good, and gives visitors a smooth experience. Put lead capture forms on your site so people can easily give you their info.

Using these tactics in your mortgage marketing funnel helps you draw in and engage with qualified prospects. This sets the stage for success in the mortgage industry. Check out resources at Becoming a Successful Mortgage Broker and Creating Effective Mortgage Marketing Strategies to boost your Mortgage Lead Generation and Mortgage Lead Magnet Creation.

Nurturing Mortgage Leads with Automated Workflows

Successful Lead Nurturing for Mortgage Lenders is more than just getting leads. It’s about keeping potential borrowers interested and moving through the Mortgage Sales Funnels. Automated workflows help a lot, especially with Mortgage Email Marketing Automation.

Email drip campaigns are a big part of nurturing leads. They send out valuable content at the right time to each lead. This keeps your brand in front of people and helps them move closer to buying a home.

Lead scoring is another key tool. It gives a score to each lead based on their actions. This way, lenders can focus on the leads most likely to buy a home. It helps your sales team work smarter.

“Nurturing mortgage leads through automated workflows is a game-changer for lenders. It allows us to stay connected with potential borrowers, provide value, and convert more leads into closed deals.”

Lead Nurturing for Mortgage Lenders is all about making a smooth, personal experience for everyone. Automation makes sure leads are looked after, engaged, and ready to buy a home.

Optimizing Mortgage Marketing Funnels for Conversion

In the mortgage industry, making your marketing funnels work better is key. By creating great mortgage content and using personal touches, you can make a smooth journey for potential borrowers. This approach helps them feel connected and encourages them to act.

Crafting Compelling Mortgage Content

Good content is vital for a strong mortgage marketing funnel. It should include everything from blogs to videos. Your content should tackle the specific issues and needs of your audience. By offering valuable advice, you become a trusted guide for potential borrowers.

Personalization and Segmentation for Mortgage Leads

Personal touches and grouping similar leads are crucial in turning leads into customers. By knowing what your leads want and need, you can send them messages and offers that hit the mark at every step. This makes the customer feel valued and boosts your chances of getting them to convert.

| Mortgage Funnel Stage | Personalization Strategies | Segmentation Criteria |

|---|---|---|

| Awareness | Personalized content recommendations based on browsing behavior | Demographics, location, interests |

| Consideration | Tailored email campaigns based on lead scoring and engagement | Credit score, loan amount, property type |

| Decision | Customized offers and pricing based on individual borrower profiles | Employment status, income, down payment |

By focusing on Optimizing Mortgage Marketing Funnels with great content and personal touches, you can boost your conversion rates. This approach helps you build strong relationships with your mortgage leads.

“The key to optimizing your mortgage marketing funnel is to put the customer at the heart of every strategy. By understanding their needs and delivering a personalized experience, you can transform leads into loyal borrowers.”

Mortgage Sales Funnels: Closing the Deal

After setting up your Mortgage Sales Funnels, it’s time to close the deal. This is where your hard work to attract, nurture, and engage potential borrowers pays off. Automated follow-up sequences make the process smooth and efficient, guiding leads through the final steps.

Automating Mortgage Follow-Up Sequences

In the mortgage industry, being fast and responsive is key. Automating your follow-ups gives you an edge, letting you quickly connect with leads. Use email marketing tools to create personalized campaigns that react to specific actions, like:

- Abandoned applications or website visits

- Inquiries about specific mortgage products or services

- Requests for more information or pricing

Understanding your mortgage leads’ needs helps you guide them through the funnel’s final stages. You can address their concerns and lead them to a successful Mortgage Conversion Rate Optimization.

“Automating your mortgage follow-up sequences can be a game-changer, helping you close more deals and drive Inbound Marketing for Mortgage Companies.”

The secret to great Mortgage Sales Funnels is a smooth, personalized experience for leads. Automating your follow-ups ensures no potential borrower is missed, boosting your conversion rates and growing your business.

Inbound Marketing for Mortgage Companies

In today’s digital world, Inbound Marketing for Mortgage Companies is key to drawing in and helping qualified leads. By making a strong Mortgage Content Marketing Strategy, lenders can be seen as trusted experts. They can teach potential borrowers and help them smoothly through the Mortgage Customer Journey Mapping.

Creating a Mortgage Content Marketing Strategy

At the heart of a good inbound marketing plan for mortgage companies is a solid content marketing strategy. This means making content that is valuable, educational, and engaging. It should tackle the problems and needs of your target audience. This can include blog posts, mortgage calculators, and more, aiming to give potential customers what they need to make smart choices.

- Identify the key topics and questions your mortgage prospects are searching for

- Create a content calendar to ensure a consistent flow of new, relevant content

- Leverage various content formats, such as videos, infographics, and webinars, to cater to different learning preferences

- Optimize your content for search engines to improve visibility and attract organic traffic

With a strategic Mortgage Content Marketing Strategy, mortgage companies can lead the industry. They can build trust with potential clients and guide them through the Mortgage Customer Journey Mapping until they’re ready to move forward.

“Content marketing is the ultimate way to reach and engage your mortgage prospects in today’s digital-first world.”

The secret to great Inbound Marketing for Mortgage Companies is a consistent, valuable, and customer-focused content strategy that matches the Mortgage Customer Journey Mapping. This way, you can draw in, nurture, and turn leads into loyal mortgage customers.

Mortgage Customer Journey Mapping

To succeed in the mortgage business, knowing the customer journey is key. Mortgage Customer Journey Mapping helps identify touchpoints and pain points in getting a mortgage. This way, mortgage pros can improve Mortgage Lead Generation and Mortgage Marketing Funnels to meet client needs.

First, define the key stages of the mortgage process. These include:

- Awareness: When someone first needs a mortgage

- Research: Gathering info and comparing options

- Application: Submitting a mortgage application

- Approval: The lender’s decision-making phase

- Closing: Finalizing the mortgage and getting the new home

Knowing these stages helps mortgage pros spot customer pain points. They can then create targeted content, use lead capture, and make the application smoother. This makes the customer’s experience better.

| Stage | Touchpoints | Pain Points | Optimization Strategies |

|---|---|---|---|

| Awareness | – Online search – Referrals – Advertising |

– Not knowing about mortgage options – Confusion about the process |

– Make informative content – Use Mortgage Lead Magnets – Improve website for Mortgage Lead Generation |

| Research | – Comparing lenders – Online research – Getting advice |

– Too much info – Trouble understanding loan terms |

– Clear, simple info – Personal advice – Mortgage Marketing Funnels |

| Application | – Sending documents – Talking with the lender – Underwriting |

– Long, hard application – Lender not clear |

– Make applying easier – Use automation and Mortgage Lead Nurturing – Be clear in communication |

By mapping the mortgage customer journey, mortgage pros can boost their marketing and sales. This approach helps engage and turn leads into customers. It’s key for a successful mortgage business in today’s market.

Lead Nurturing for Mortgage Lenders

In the competitive mortgage industry, it’s key to turn potential borrowers into clients. Lenders who focus on Mortgage Drip Campaigns and Mortgage Email Marketing Automation see better conversion rates. They also build strong relationships with their leads.

Leveraging Mortgage Drip Campaigns

Drip campaigns are great for nurturing mortgage leads. They send automated, personalized emails to keep leads interested. These campaigns share valuable info, solve common problems, and build trust. This leads to more people becoming clients.

Mortgage Email Marketing Automation

Automated email marketing is vital for mortgage lead nurturing. With marketing automation tools, lenders can send timely, relevant emails. They can also track how well their campaigns work. This keeps leads interested and boosts the chance they’ll apply for a mortgage.

Using Lead Nurturing for Mortgage Lenders, Mortgage Drip Campaigns, and Mortgage Email Marketing Automation together gives lenders an edge. They can keep their leads engaged and offer a personalized experience. This helps build a loyal client base and grows their business sustainably.

Conversion Rate Optimization for Mortgage Funnels

Boosting your mortgage marketing funnels is key to growing your business. Mortgage Conversion Rate Optimization uses various strategies to make your lead generation better.

A/B testing is a big part of CRO. It lets you test different versions of your website and marketing to see what works best. You can test things like headlines, calls-to-action, and even the whole user experience.

- Make the website better: Improve your mortgage site’s design and ease of use to make visitors happy and engaged.

- Make content personal: Use data to make your mortgage content fit what your leads want, which can boost your results.

- Make it easy to get leads: Make your lead forms simple and clear to get more people to move forward in the process.

| Optimization Tactic | Potential Impact | Key Metrics to Track |

|---|---|---|

| A/B Testing | Find the best content and designs | Conversion rate, click-through rate, bounce rate |

| User Experience Improvements | Make customers stick around and engage more | Time on site, pages per session, bounce rate |

| Personalization and Segmentation | Make your marketing hit the mark better | Lead conversion rate, engagement metrics |

With a strong Mortgage Conversion Rate Optimization plan, you can make your marketing funnels work better. This means more leads and more successful loans.

“Optimizing your mortgage marketing funnels for maximum conversions is a crucial step in driving growth for your mortgage business.”

Mortgage Content Marketing Strategies

In the world of mortgage lending, content marketing is key to success. It helps you connect with your audience, get more leads, and increase conversions. By matching your mortgage content with the customer journey, you can really grab their attention.

Repurposing Mortgage Content Across Channels

Repurposing content is a smart move in mortgage marketing. Instead of making new content for each platform, you can use what you already have. This saves time and ensures your brand message stays consistent throughout the Mortgage Customer Journey Mapping.

- Turn blog posts into videos or podcasts to reach more people.

- Use webinar recordings to make guides or checklists for Mortgage Content Marketing Strategies.

- Make social media posts into e-books or whitepapers for deeper insights.

By repurposing content, mortgage companies can boost their Inbound Marketing for Mortgage Companies efforts. They can make the most of their resources and reach more people through various channels.

“Effective content marketing is like a well-oiled machine – it leverages existing resources to create a symphony of engaging, informative, and conversion-driven content.”

To succeed in mortgage content marketing, know your audience well. Understand their problems and what type of content they like. With a strategic and cohesive content plan, you can build trust and strong relationships with your customers.

Conclusion

In this article, we’ve looked at how to make a mortgage lead funnel that boosts conversions. We’ve covered the key steps for mortgage lenders to get, keep, and turn leads into customers.

Using mortgage lead generation methods like eye-catching lead magnets and a site focused on converting visitors can draw in potential buyers. Automated systems and tailored mortgage marketing funnels help you guide leads through their choices and seal the deal.

The secret to doing well is creating a mortgage funnel that maximizes conversions. Keep improving your content, how you group your audience, and your follow-up plans. This way, you can fully grow your mortgage business and achieve lasting growth. Adopt these strategies, and you’re set for success in mortgage marketing.

FAQ

What are the key steps in creating an effective mortgage funnel that maximizes conversions?

To make a great mortgage funnel, first, understand the customer’s journey. Then, map out the funnel’s stages. Use tactics to draw in, support, and turn mortgage leads into customers.

How can mortgage lenders generate more qualified leads?

Mortgage lenders can get more qualified leads by using lead magnets. They should also make their website great for catching leads. And, they should use content marketing well to reach and keep potential borrowers interested.

What are the best practices for nurturing mortgage leads through automated workflows?

For effective lead nurturing, mortgage lenders should use email marketing automation. They should also score leads and talk to them in a way that feels personal. This keeps potential borrowers engaged and moving forward.

How can mortgage lenders optimize their marketing funnels for increased conversions?

To get more conversions, mortgage lenders should make their content about mortgages really interesting. They should use personal touches and group people based on their interests. And, they should always test and improve their funnel.

What are the key strategies for closing the deal in the mortgage sales funnel?

Closing deals means automating follow-ups, offering top-notch customer service, and helping borrowers through the last steps of the funnel.

How can mortgage companies leverage inbound marketing to attract and nurture leads?

Inbound marketing for mortgage companies means making a strong content plan. It’s about sharing helpful, educational content. And, using the mortgage journey to draw in and support leads.

Why is mortgage customer journey mapping important for optimizing the lead funnel?

Mapping the mortgage customer journey helps lenders see all the touchpoints and issues borrowers face. This lets them make the funnel better and give a more personal, helpful experience.

What are the best practices for lead nurturing in the mortgage industry?

Good lead nurturing for mortgage lenders means using mortgage-focused drip campaigns and email automation. It also means keeping potential borrowers interested and moving along the funnel.

How can mortgage lenders optimize the conversion rate of their marketing funnels?

To get more conversions, mortgage lenders should test different things, make the user experience better, and keep refining the funnel. This makes their lead generation and nurturing work better.

What are some key mortgage content marketing strategies lenders should consider?

For mortgage content marketing, focus on making content that helps and matches the customer’s journey. Use content in many places and use it to help lead generation and conversions.