In today’s fast-paced financial world, asset allocation client engagement emails are key for advisors. They help connect with potential investors. These emails can open new doors and build lasting relationships.

By crafting personalized messages, you can stand out in a crowded inbox. This sparks interest in your services.

Effective cold emailing isn’t just about sending mass messages. It’s about creating content that addresses potential clients’ needs. By building trust and showing your expertise, you can turn cold leads into warm prospects.

Technology can greatly boost your investor outreach campaigns. Automation tools help you send emails at the right time, track engagement, and follow up precisely. This way, you can scale your efforts while keeping a personal touch.

Key Takeaways

- Personalization is key in asset allocation client engagement emails

- Focus on providing value to potential investors from the first contact

- Use technology to optimize timing and track engagement in investor outreach campaigns

- Build trust by showcasing expertise and understanding client needs

- Consistent follow-up is crucial for converting cold leads into clients

Understanding the Asset Allocation Advisory Landscape

The world of asset allocation is changing fast. This is due to market shifts and new client needs. Advisors need to keep up with REIT marketing and real estate tactics to stay ahead.

Current Market Dynamics in Investment Advisory

Investment advice is now more about personal plans. Clients want advisors who can handle complex markets and offer custom solutions. Advisors must mix old asset allocation with new real estate strategies.

Identifying Target Client Segments

Good advisors know their clients well. Wealthy people and big investors want detailed REIT info. Younger clients are interested in real estate too.

| Client Segment | Primary Interests | Preferred Communication |

|---|---|---|

| High-net-worth individuals | Diversified portfolios, REITs | Personalized reports, exclusive insights |

| Institutional investors | Large-scale real estate projects | Detailed market analysis, risk assessments |

| Millennials/Gen Z | Sustainable investments, tech-driven REITs | Mobile-friendly updates, social media engagement |

Regulatory Considerations for Email Outreach

Advisors must follow strict email rules. They need to obey anti-spam laws and financial rules. Good REIT marketing is both informative and legal.

“In the digital age, successful asset allocation advisors combine market expertise with compliant, targeted outreach strategies.”

Asset Allocation Client Engagement Emails: Best Practices

Creating persuasive email templates is key for asset allocation advisors. These emails are powerful tools in property acquisition strategies. They help advisors connect with investors and show their expertise.

To make impactful emails, focus on three things: personalization, value proposition, and clear call-to-action. Make your message fit the specific needs and goals of your audience. Show how your asset allocation services can help their investment portfolio.

Keep your email content short and easy to read. Use short paragraphs and bullet points to make important info stand out. Add market insights or success stories to show your expertise and build trust.

“The most effective emails are those that provide immediate value to the recipient, establishing trust and encouraging further engagement.”

Think about adding a table that compares different asset allocation strategies. This shows your expertise:

| Strategy | Risk Level | Potential Return | Ideal Investor Profile |

|---|---|---|---|

| Conservative | Low | Moderate | Risk-averse, near retirement |

| Balanced | Medium | Moderate to High | Middle-aged professionals |

| Aggressive | High | High | Young investors, long-term growth seekers |

By following these best practices, you can make engaging emails. These emails will resonate with potential clients and help your asset allocation advisory business succeed.

Crafting Compelling Subject Lines for Investment Advisors

Creating effective subject lines is key for investment advisors to grab potential clients’ attention via email. Getting this right can greatly increase open rates and conversions for REIT persuasive email templates and investor relations content.

Psychology Behind High-Converting Email Subjects

Great subject lines use psychology to their advantage. They spark curiosity, create a sense of urgency, or promise something valuable. For investment advisors, talking about potential gains or special deals can really work. For example, “Exclusive REIT Opportunity: Limited Time Offer” does just that.

A/B Testing Strategies for Subject Lines

To make your subject lines better, try A/B testing. This means sending two different subject lines to a small part of your email list. Then, send the winning version to everyone else. Test things like length, personal touch, and tone to find what works best.

| Subject Line A | Subject Line B | Open Rate |

|---|---|---|

| Discover Top-Performing REITs | Your Personalized REIT Portfolio Analysis | A: 22%, B: 28% |

| Limited Time: REIT Investment Seminar | Exclusive Invite: REIT Strategies Revealed | A: 18%, B: 25% |

Avoiding Spam Triggers in Financial Communications

When writing subject lines for investor relations content, watch out for spam triggers. Stay away from too much capitalization, lots of exclamation points, and “get rich quick” phrases. Use clear, professional language that meets standards while still grabbing attention.

Personalizing Cold Emails for REIT Investors

Making cold emails personal is key in today’s market. Tailoring your message can increase engagement and responses. This is especially true for real estate syndication proposals and commercial property solicitations.

First, research your target investors. Learn about their past investments, what they like, and how much risk they’re willing to take. Use this info to craft content that meets their needs and goals.

Here’s a simple way to personalize your emails:

- Address the investor by name

- Reference their specific investment interests

- Highlight relevant properties in their preferred locations

- Showcase potential returns based on their risk profile

Keep your emails short and to the point. REIT investors get a lot of emails. Make yours stand out with clear, useful info.

“Personalization is not about first/last name. It’s about relevant content.” – Dan Jak

Use data to improve your emails. Track how many people open them, click on links, and respond. This will help you make your emails better over time.

| Personalization Element | Impact on Response Rate |

|---|---|

| Investor Name | +5% |

| Investment History | +10% |

| Property Location | +15% |

| Custom ROI Projection | +20% |

By using these personalization tips, you’ll make your real estate syndication proposals and commercial property solicitations more appealing. This will help you connect better with REIT investors.

Building Trust Through Value-First Communication

Trust is key to successful asset allocation advisory. Advisors can build trust by focusing on value-first communication. This is crucial when creating fund-raising pitch decks or capital raise prospectuses.

Educational Content Integration

Adding educational content to client communications is a great way to build trust. Advisors can share informative newsletters, webinars, or blog posts. These explain complex investment concepts, helping clients make better decisions.

Market Insight Sharing Techniques

Sharing market insights shows expertise and keeps clients informed. Advisors can include market updates, trend analysis, and economic forecasts in their pitch decks. This helps clients understand the reasoning behind investment choices.

Social Proof Implementation

Using social proof in communications boosts credibility. Advisors can add case studies, client testimonials, and performance metrics to their prospectuses. These elements show real success, helping potential investors see positive outcomes.

| Trust-Building Element | Implementation Method | Impact on Client Relationship |

|---|---|---|

| Educational Content | Newsletters, Webinars, Blog Posts | Increases client knowledge and decision-making confidence |

| Market Insights | Regular Updates, Trend Analysis | Demonstrates expertise and justifies investment strategies |

| Social Proof | Case Studies, Testimonials | Builds credibility and showcases real-world success |

By consistently delivering value, advisors can build trust. This improves their reputation and client engagement. It also helps in retaining clients.

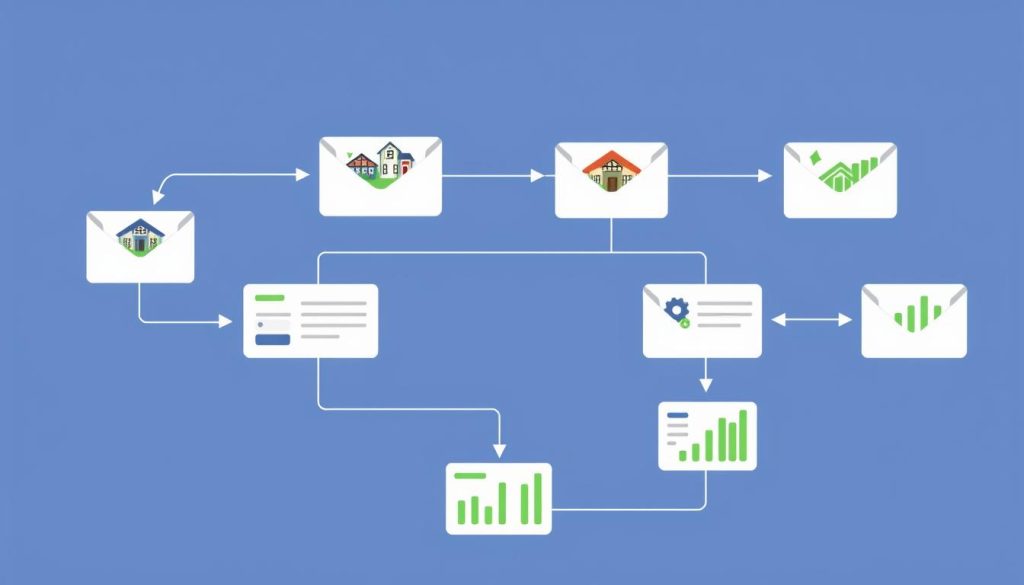

Email Sequence Design for Property Investment Proposals

Creating effective email sequences is key for real estate investing. A well-designed sequence can boost engagement and conversion rates for investment proposals.

Timing and Frequency Optimization

Timing is crucial for email engagement. Send your first email on Tuesday or Wednesday morning. This is when professionals are most likely to check their inboxes.

Space subsequent emails 3-5 days apart. This keeps interest without overwhelming recipients.

Follow-up Strategy Development

Develop a follow-up strategy to nurture leads. Start with educational content on real estate investing. Then, move to specific property acquisition strategies.

End with a personalized investment proposal.

Call-to-Action Placement

Strategic placement of calls-to-action (CTAs) is key. Include a primary CTA in the middle of each email. Add a secondary one at the end.

For property investment proposals, effective CTAs might include:

- Schedule a consultation

- Download our investment guide

- View property portfolio

| Focus | CTA | |

|---|---|---|

| 1 | Introduction to real estate investing | Download guide |

| 2 | Property acquisition strategies | Watch webinar |

| 3 | Investment proposal | Schedule call |

By optimizing your email sequence design, you can effectively communicate your real estate investing tactics and property acquisition strategies. This leads to higher engagement and conversion rates.

Data Analytics for Email Campaign Optimization

Data analytics is key for better investor outreach campaigns. Asset allocation advisors can improve their REIT marketing by analyzing important metrics. This helps boost email performance and client engagement.

Email open rates are a key indicator of success. A high rate means your subject lines grab attention and your timing is right. Tracking this helps see how well your outreach starts.

Click-through rates show how interesting your content is. If people click on your links, it means they find your message appealing. This helps you make your content better for future campaigns.

| Metric | Importance | Target Range |

|---|---|---|

| Open Rate | Measures subject line effectiveness | 20-40% |

| Click-Through Rate | Indicates content relevance | 2-5% |

| Conversion Rate | Shows campaign success | 1-3% |

Conversion rates are the best way to measure campaign success. They show how many people took the action you wanted, like scheduling a meeting or asking about REIT opportunities.

By looking at these data points regularly, advisors can make their marketing better over time. This approach leads to more effective campaigns and stronger investor relationships.

Integration of Real Estate Investment Opportunities

Integrating real estate investment opportunities in client emails can really boost interest. This method combines real estate syndication proposals with targeted commercial property solicitations. It makes for a strong investment case.

REIT Portfolio Presentation Methods

When showing REIT portfolios, keep it simple and visually appealing. Use charts to show performance and diversification. Highlight key properties to give investors a clear view of what they’re looking at.

| REIT Name | Property Type | Annual Return | Dividend Yield |

|---|---|---|---|

| Prologis | Industrial | 15.2% | 2.5% |

| Equity Residential | Residential | 11.8% | 3.2% |

| Simon Property Group | Retail | 13.5% | 5.7% |

Investment Case Study Integration

Use real-world case studies to show the success of real estate syndication proposals. These stories highlight how investors profited from certain commercial property solicitations. Share details on the initial investment, improvements, and final returns to show the full investment journey.

“Our syndication of a multi-family complex in Austin resulted in a 22% IRR for investors over a 5-year hold period, surpassing initial projections by 15%.”

By mixing clear REIT presentations with engaging case studies, you can craft emails that grab potential real estate investors’ attention. This approach drives engagement.

Compliance and Legal Considerations in Financial Email Marketing

Financial email marketing is a tricky field. Advisors must send out messages that are both clear and legal. The capital raise prospectus is a key guide for what to share in emails.

Important rules include the CAN-SPAM Act. It requires clear opt-out options and accurate sender info. The SEC’s marketing rule also affects how you can talk about investment results in emails.

To stay compliant and connect with clients, follow these tips:

- Always clearly state who you are and your role in the investment

- Don’t promise specific returns or results

- Include all necessary warnings and disclaimers

- Make sure all claims are true and backed up

- Keep records of all marketing emails

It’s tough to meet legal standards and market well. Focus on sharing useful info and insights. This way, you meet legal needs and gain trust from potential clients.

| Compliance Area | Best Practice |

|---|---|

| Identity Disclosure | Include firm name and contact information in every email |

| Performance Data | Use standardized time periods and include all required disclosures |

| Risk Disclosure | Clearly state potential risks associated with investments |

| Opt-out Mechanism | Provide a clear, easy-to-use unsubscribe option in each email |

Putting compliance first in your email marketing helps your firm and builds trust with investors. Always be clear and accurate when talking about financial opportunities via email.

Measuring Success: KPIs for Asset Allocation Email Campaigns

Tracking key performance indicators (KPIs) is crucial for asset allocation email campaigns. It involves looking at conversion rates, checking engagement, and figuring out return on investment. These metrics help make your fund-raising pitch decks and investor outreach better.

Conversion Rate Analysis

Conversion rates show how many email recipients do what you want them to. For asset allocation advisors, this could be booking meetings or asking for portfolio reviews. Watching these rates helps see if your emails and calls-to-action are working.

Engagement Metrics Tracking

Keep an eye on how people interact with your emails. Important metrics include:

- Open rates

- Click-through rates

- Time spent reading

- Forward and share rates

These insights help you improve your investor outreach and fund-raising pitch decks.

ROI Calculation Methods

To figure out the return on investment for your email campaigns, use this formula:

ROI = (Revenue generated – Campaign costs) / Campaign costs x 100

Think about both direct and indirect revenue. This includes immediate investments and building long-term client relationships.

| KPI | Calculation Method | Target Range |

|---|---|---|

| Conversion Rate | (Actions Taken / Emails Delivered) x 100 | 2-5% |

| Open Rate | (Emails Opened / Emails Delivered) x 100 | 15-25% |

| Click-Through Rate | (Clicks / Emails Delivered) x 100 | 2-5% |

| ROI | (Revenue – Costs) / Costs x 100 | 200-400% |

Leveraging Technology for Email Automation

Email automation is a big deal for asset allocation advisors. It makes sending out emails easier and helps keep clients engaged. With the right tools, you can send emails that feel personal, even if you’re sending them to many people.

Smart automation platforms let you create emails that really speak to your audience. They can sort your list based on what each client likes or needs. So, everyone gets emails that are just right for them.

Tracking and analytics are huge pluses of email automation. You can see who’s reading your emails and what they’re doing with the links. This info helps you make your emails even better over time. By looking at these numbers, you can make your emails more effective and build stronger relationships with your clients.

But remember, automation is just a tool. It’s meant to help you, not replace you. Use it to make your communications better, not to make them feel cold. The aim is to use automation to add more value to your clients’ lives, building stronger connections in the world of asset allocation.